Contest Property Taxes

The Current Deadline to Contest Your Property Taxes is June 1

One of the consequences of the COVID-19 crisis is many property values have taken a hit. While this means your home or property may sell for less, it also may mean that your current property tax valuation is way too high. This is your opportunity to contest how the Appraisal District has valued your home during this crisis!

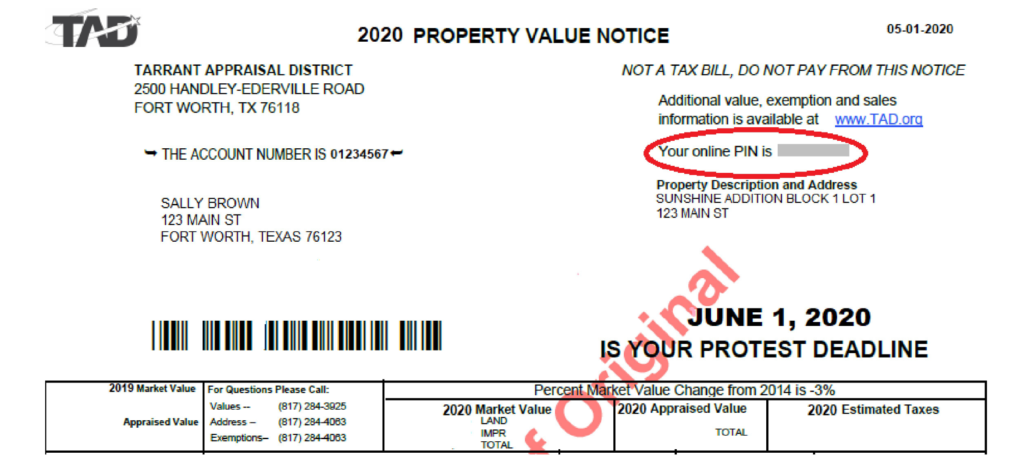

The Tarrant Appraisal District has already begun sending out 2020 property values notices. Once you receive yours, you have the chance to contest the new valuation of your home or property to help lower your property tax bill.

Here are the helpful steps to guide you through the process.

Step 1:

Find the online PIN on your Property Value Notice

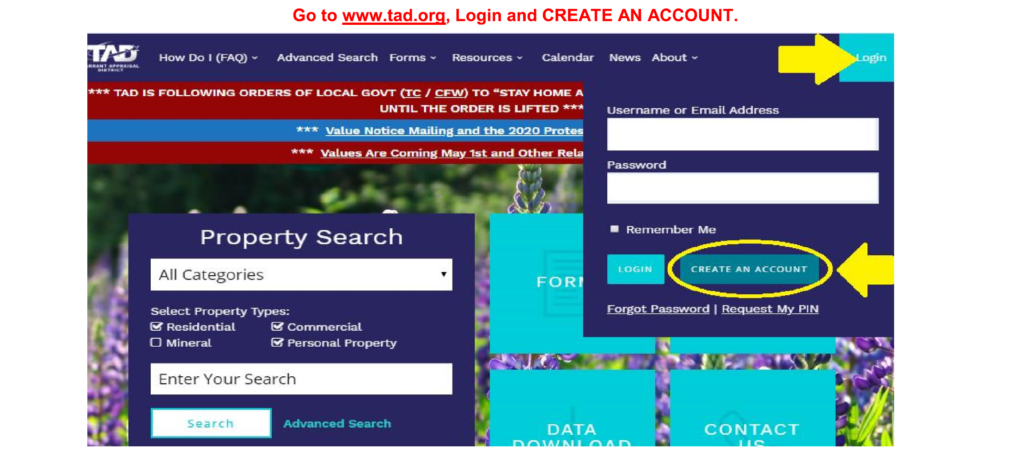

Step 2:

Go to www.tad.org. Login or CREATE AN ACCOUNT

Step 3:

Follow the prompt, provide a compelling reason for your contest (e.g. incorrect appraised market value, value is unequal compared with other properties, etc.), and upload any supporting documentation.

Once you successfully file your online contest, a confirmation will be sent to you and you will get written notice of a hearing date and time to appear (or meet via phone or computer) before the Appraisal Review Board.

Here is a helpful video from the Comptroller on how to successfully present your case at your ARB hearing: https://comptroller.texas.gov/taxes/property-tax/video/homeowner-protest/presentation_html5.html

Here is a Tarrant County list of Providers who offer Free Assistance to Homeowners in the protest process here: https://www.tad.org/wp-contentpdf/templates/FreeAssistanceProviderList.pdf or you can hire a service to assist as well.

If you have any further questions or need help, please reach out to us right away. We are here for you!